What We Do

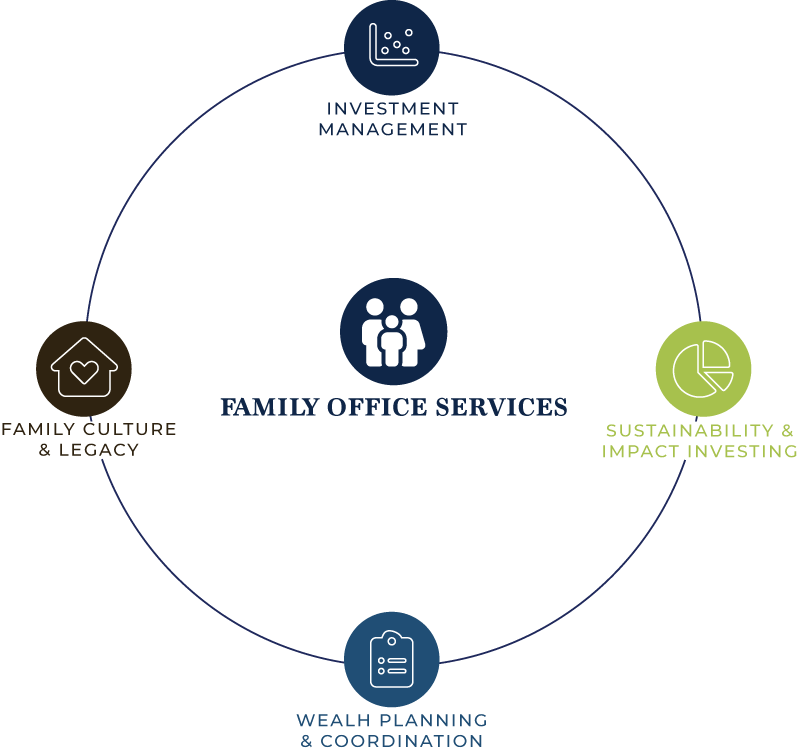

Family Office Services

We have the privilege of helping successful people solve complex problems and communicate sophisticated financial plans to their families. We’re passionate about generational stewardship, and provide tailored solutions for every aspect of wealth & asset management.

Wealth planning and coordination

Wealth creates both opportunities and challenges. We help families navigate the complexities of financial, investment, and other planning decisions.

Family legacy, culture and governance

The strength of your legacy is in the values you share with future generations. We help you build a resilient family culture that reflects this powerful common purpose.

Investment management

Successful investing has traditionally been measured by “beating the market”. We set a different standard of investment success that judges performance on a client’s ability to achieve their goals.

Sustainability & social impact investing

Investing allows you to do more than simply grow your portfolio. With your wealth, you have the power to change the world. That’s why we strive to be at the forefront of social impact investing.

The returns on a portfolio consisting primarily of Environmental, Social and Governance (“ESG”) aware/Socially Responsible Investing (“SRI”)/Sustainable investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because ESG/SRI/Sustainable investments criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria.

The term “Family Office Services” is being used as a term of art and not to imply that Steward Partners and/or its employees are acting as a family office pursuant to Investment Advisers Act of 1940.

Private Client Services for Established Professionals

Dynamic Planning for a Vibrant Life

For more than two decades, we’ve provided wealth management for ultra-high-net-worth families, and now, we are excited to offer sophisticated family office services for the next generation of well-established professionals. Through holistic financial planning, we help driven, successful people align their wealth with their goals.

How We Help

We believe a rich life means continuous change, and with many of these changes come significant financial implications. Our goal is to help leverage valuable opportunities while safeguarding your wealth and your future. As your life evolves, we’ll offer insight and guidance on many important topics, including:

- The purchase and financing of a new home

- The financial implications of starting a family

- How to fund college for future generations

- Planning for retirement

- Financial considerations associated with marriage, divorce, or death of a loved one

- Inheritance & philanthropic planning

- Planning and caring for aging family members

- What to look for in an estate planning attorney and what documents you may need

- Life, disability, long term care, and other types of insurance

- Income, estate, and inheritance tax planning strategies

- The complexities of noncash compensation (restricted stock units, incentive stock options, and more)

Wealth Planning & Coordination

Our team offers a multidisciplinary approach to wealth management that marries all aspects of financial planning to steward your wealth. When reviewing your financial picture, we’ll systematically address each of the following stages:

01. Discovery

Once we’ve mutually determined our partnership is a good fit, we’ll engage in deeper conversations so we may learn what’s important to you. We’ll get to know you and your family, gather financial data, and develop a comprehensive understanding of your situation.

02. Financial analysis & strategic planning

We’ll create and analyze your balance sheet, pinpointing strengths and shortcomings so that we may develop strategies that strengthen your overall financial wellbeing.

03. Life planning

Wealth management is never static. We meet with you frequently so that we may help you analyze and navigate important life events such as marriage, retirement, or selling a business.

04. Risk management

Once we have analyzed your situation, we’ll help you understand the potential threats to your financial wellbeing and present cost-effective, risk management solutions.

05. Inheritance, estate, and multigenerational planning

After thoroughly understanding your long-term goals, desires, and resources we partner with your estate attorney to help guide you through the estate planning process. Generational planning is a powerful component of wealth management, so we facilitate Family Summits for clients who qualify. We also offer pro-bono financial counseling to younger family members.

06. Tracking & monitoring

We continually monitor the economy and markets, track the progress of your financial plan and portfolio, and collaborate with you to help ensure your wealth is aligned with your goals. Should you choose, we assist in communicating your plan to the pertinent people in your life.

Family Legacy, Culture, and Governance

Nurturing a resilient family culture that reflects shared values and purpose

Family Summit

We believe sharing your financial plan with your family is incredibly important. It’s vital to communicate not only your desires for the distribution of your wealth, but the values that drive your financial plan. That’s why we created our Family Summit Initiative. When you’re ready to communicate your planning motives and decisions to those you care about most, we help design and facilitate an in-depth "Family Summit" to share your plan with your family. We take tremendous pride in helping clients thrive for generations. Our mission is to make sure everyone is on the same page and invested in a common goal.

Next Generation Initiative

Our Next Generation Initiative is a passion project that delivers financial education to your next generation of family members. We help them understand the financial implications of major life decisions and provide tools to help them navigate those decisions with wisdom and confidence.

Investment Management

Our standard for success is financial

wellbeing and a life filled with joy.

We take a holistic approach to investment management, working with you to create custom portfolios

that reflect your values and objectives. Our goals-driven investment process emphasizes:

-

Discussion and

data gathering -

Asset allocation

and management -

Manager selection

and monitoring -

Transparent

reporting

The first step is helping you and your family identify your financial goals. Once we understand what you want to achieve, we’ll analyze your current situation and develop a strategic plan to help you get where you want to be.

Following your unique strategic plan, we’ll build a custom portfolio comprised of diverse assets that reflect your investment goals.

We’ve developed a rigorous due-diligence process through which we identify managers and monitor their performance. We meet with our asset managers directly several times per year.

We leverage state-of-the-art technology to provide you meaningful and transparent reporting

Investing involves risk and you may incur a profit of loss regardless of strategy selected, including diversification and asset allocation.

Interested in making the world a better place while pursuing your financial goals?

Want to inspire younger family members to take an active interest in your family wealth?

Institutional Consulting

We provide financial education, investment guidance, and fiduciary consulting for a variety of organizations.

-

Non-profit

organizations -

Foundations

& endowments -

Defined benefit

plan sponsors -

Defined contribution

plan sponsors

Our Services

For decades, we’ve helped organizations achieve their financial objectives while meeting fiduciary obligations. With our extensive resources and tailored service model, we’re prepared to help your team develop a world-class investment strategy.

We will review and develop Investment Policy Statements to help facilitate continuity in the decision-making process. We will coordinate our efforts with your executive team, board members, and other professional providers (trustees, attorneys, and CPAs) to ensure continuity.

Our institutional consulting services include:

- Cash flow & risk management

- Asset allocation guidance

- Investment research & manager selection

- Performance reporting

- Analysis & due diligence

- Fiduciary education and best practices

Social Impact Investing

Your Money Can Make a Difference

Investing allows you to do more than simply grow your portfolio. With your wealth, you have the power to change the world. That’s why social impact investing is so important to us. Our goal is to help you generate competitive returns while having a positive impact on society and the world around you.

How it Works

When seeking to maximize both your returns and your impact, we’ll discuss what’s important to you and then apply the appropriate environmental, social, and governance (ESG) lenses to identify investment opportunities that reflect your values and goals. Our Social Impact Scorecard is a tool that provides insight into how well your portfolio aligns with your values. This may allow us to improve your personalized impact across dozens of real-world metrics.

Leaders in ESG

Our team has helped revolutionize reporting that depicts the positive changes intentional investment choices make in the world. Our ESG work has been recognized within the investment community, and our principal advisors have been featured speakers at the Sustainable Investment Solutions Symposium, highlighted in a video featured on FundFire (a subsidiary of the Financial Times), and honored by ringing the closing bell on the New York Stock Exchange.

The returns on a portfolio consisting primarily of Environmental, Social and Governance (“ESG”) aware/Socially Responsible Investing (“SRI”)/Sustainable investments may be lower or higher than a portfolio that is more diversified or where decisions are based solely on investment considerations. Because ESG/SRI/Sustainable investments criteria exclude some investments, investors may not be able to take advantage of the same opportunities or market trends as investors that do not use such criteria.